She’s written several business books and has been published on sites including Forbes, AllBusiness, and SoFi. She writes about business and personal credit, financial strategies, loans, and credit cards. Pilot is a finance, accounting, and tax services firm built for VC backed startups.

700+ Clients Rely on YPTC’s Nonprofit Accounting Services

Finally, the software’s CRM helps you get to know and retain donors via targeted engagement to keep your cash flow healthy. Therefore, we understand your specific needs and reporting requirements. We also understand your limitations nonprofit bookkeeping service and will meet you where you’re at. You have real-time access to your books and tailored grant financial statements. Essentially, you should view bookkeeping as the financial oversight process that’s necessary for operating your nonprofit daily.

Bookkeeping for Nonprofits: A Basic Guide & Best Practices

FreshBooks’ software stands out for its ability to track expenses and restricted funding. For example, time-tracking tools tell you how long it takes an employee to complete a project’s task. Once you know the time employees spend on a project, you can allocate project funds to those employees. You can also connect a bank account and FreshBooks will generate spending reports.

It’s time to fix your nonprofit’s accounting

As a bookkeeper, it may be necessary to meet with your nonprofit’s accountant weekly, monthly, quarterly, and yearly. Weekly meetings with an accountant should go over how to adhere to your budget goals and track fund accounting. https://www.bookstime.com/ The American Institute of Certified Public Accountants (AICPA) and the Financial Accounting Standards Board (FASB) have created standard accounting principles (GAAP) for nonprofits to follow. As you collect funds, pay expenses, and prepare reports, keeping these principles in mind is vital. Nonprofit bookkeeping refers to the recording, tracking, and analyzing of an organization’s revenue and expenses. Nonprofits must be transparent in their bookkeeping to remain tax-exempt.

The Essential Plan offers cash-basis accounting and starts at https://www.facebook.com/BooksTimeInc/ $300 a month. The Growth Plan is the next plan up, includes accrual-based accounting and starts at $900 per month. You also have the option to build a Custom Plan that offers controller support, and fractional CFO services. IgniteSpot Accounting boasts a more personalized approach to outsourced accounting services. Its bookkeeping packages include certified virtual bookkeepers and a dedicated accountant for your business.

Nonprofit Bookkeeping vs. Accounting

- Don’t miss the accounting software resources put together by Nav experts.

- When you start a nonprofit bank account, you’ll want to authorize someone as a signatory.

- Improve your business credit history through tradeline reporting, know your borrowing power from your credit details, and access the best funding – only at Nav.

- A bookkeeping service can manage your accounting software for you, which takes a lot of administrative work off your to-do list.

- Financial statements provide insight into how much money your nonprofit has, where you spend it, and how it’s used.

You should also hire a financial officer or a treasurer who knows how to do bookkeeping for a nonprofit and is familiar with specialized accounting software. The basis for an accurate bookkeeping and accounting system is recording all financial transactions. For-profit entities are individuals, corporations, or partnerships that conduct business for profit. In this case, shareholders, investors, tax authorities, management, and suppliers are interested in the entity’s financial position, and that’s what for-profit accounting focuses on.

Didn’t find the business you were looking for?

A nonprofit reconciles bank accounts by comparing the recorded amounts to the amounts on bank statements. NetSuite’s accounting software offers accounts receivable and payable, cash management, fixed asset management, a general ledger and tax management solutions. When we contacted a sales representative for a starting price, we were told there is no set starting price as each solution is uniquely catered to the NetSuite client. With no payroll tools, Quicken allows solo-run nonprofits that rely on volunteers to perform basic business accounting, such as allocating funds based on donor intent to different categories or budgets. In addition, they can track expenses and capture receipts to simplify tax filings and report to donors the nonprofits’ overhead-versus-project costs.

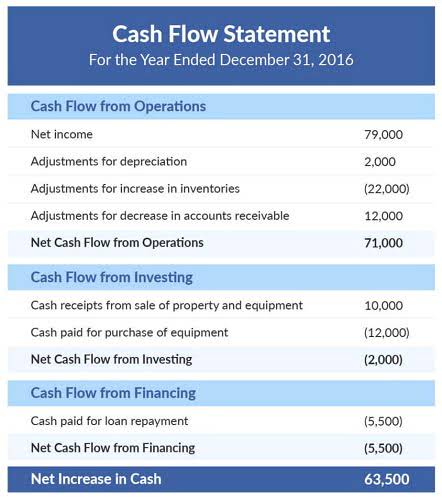

Nonprofit cash flow statements will refer to “change in net assets” instead of “net income,” and will sometimes list cash flows that are restricted to certain uses. Just like the statement of financial position, the statement of activities keeps net assets that have conditions and stipulations attached to them separate from unrestricted funds. As you choose your organization’s bookkeeper and financial software, remember to consider your organization’s needs and abilities. Software that provides top-level financial tools isn’t helpful if your staff and board don’t understand how best to use it.

- Don’t use your personal bank account to receive, hold or disburse money for your nonprofit.

- Kristine Ensor is a freelance writer with over a decade of experience working with local and international nonprofits.

- Like the income statement, it tells you how “profitable” your NFP was over a given period by showing your revenue, minus your expenses and losses.

- And we can offer you on-demand advice on grant utilization, fundraising strategy, tax compliance, and other topics that often trip up growing nonprofits.

- As a nonprofit professional she has specialized in fundraising, marketing, event planning, volunteer management, and board development.

The Best Guide to Bookkeeping for Nonprofits: How to Succeed

All of our clients are backed by a fully staffed accounting department. Whether you spend one dollar on paper clips or $1,000 on a venue for a fundraiser, every transaction must be recorded. To do this, have your bookkeeper monitor and record your transactions or invest in a software solution that automatically tracks each expense for you. We’ll create a custom price quote that’s tailored for you— to ensure you get the support you need without paying for anything that you don’t.